No parent wants to imagine being unable to care for their child—but planning for the unexpected is one of the most important things you can do to protect your child’s future. In this post, Illinois Child Guardianship FAQs: What Every Parent Needs to Know, we answer the most common questions families have about how to legally appoint a guardian for …

Shelbyville Natives Nohren and Rincker Appointed to ISBA Rural Practice Section Council

The Illinois State Bar Association (ISBA) has announced the appointment of attorneys Cari Rincker and Elizabeth E. Nohren to the ISBA Rural Practice Section Council for the 2025–2026 term. This council focuses on addressing the unique challenges and opportunities in providing legal services to Illinois’ rural communities. Rincker, a dedicated advocate for rural justice initiatives, expressed her enthusiasm about the …

Ask Sam: What is the USPTO?

If you’re a business owner, entrepreneur, or creative professional, you’ve likely come across the term “USPTO.” But what exactly is it, and why is it important for protecting your brand and intellectual property? The United States Patent and Trademark Office (“USPTO”) is a federal agency within the U.S. Department of Commerce responsible for granting patents and registering trademarks. Its primary …

Ask Sam: How Do I Choose a Strong Trademark?

Whether you’re launching a new business, product, or service — or looking to strengthen the protection of an existing one — choosing the right trademark is one of the most important decisions you’ll make. A trademark is more than just a name or logo; it’s the face of your brand, a legal asset, and a powerful tool to set you …

What Are the Types of Guardianships in Illinois?

If you’re caring for a loved one who cannot make decisions for themselves due to age, disability, or incapacity, you may need to seek legal guardianship. But what are the types of guardianships in Illinois? And how do you know which one is right for your situation? In this blog post, we break down the different types of guardianships in …

How to Appoint a Guardian for Your Child in Illinois

No parent wants to imagine a world where they’re not around to care for their child. But appointing a legal guardian ensures that, even in your absence, your child will be raised by someone you trust. In this article, we’ll walk you through how to appoint a guardian for your child in Illinois — a critical step that too many …

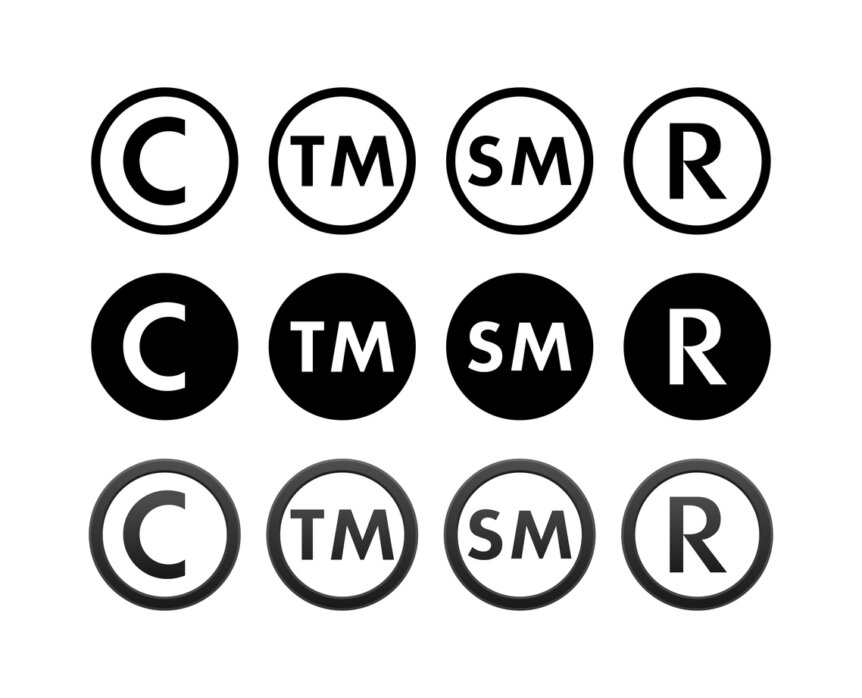

Ask Sam: What is the Difference Between the ™, ℠, ®, and © Symbols?

If you’ve ever looked closely at brand names, logos, or creative works, you’ve likely seen the symbols TM (™), SM (℠), Registered Trademark (®), and Copyright (©). While they all relate to intellectual property protection, they serve different legal purposes. Understanding these symbols can help businesses and creators protect their brands and works effectively. The Trademark (™) Symbol The TM …

What Are the Responsibilities of a Guardian for a Disabled Adult in Illinois?

If you’ve recently been appointed as guardian for a disabled adult in Illinois — or you’re considering petitioning for guardianship — it’s essential to understand exactly what this legal role involves. Guardianship isn’t just a title; it’s a serious, court-supervised responsibility with significant legal and ethical obligations. What are the responsibilities of a guardian for a disabled adult in Illinois? …

Are Prenuptial Agreements Enforceable in Illinois?

One of the most common questions couples ask before getting married is: “Are prenuptial agreements enforceable in Illinois?” If you’re planning to get married and thinking about signing a prenup, this is an important question. In Illinois, prenuptial agreements can be a helpful way to set clear expectations and protect both parties financially—but only if they meet certain legal standards. …

How Illinois Farmers Can Keep the Family Farm in the Family

For generations, farms across Illinois have been passed down from parent to child. But today, many families are asking the same big question: “How can I keep the farm in the family and ensure a smooth transition to the next generation?” Estate and succession planning is essential for any business owner—but it’s especially important for farmers. Unlike other industries, farms …

Is Divorce Mediation Required in Illinois?

If you’re going through a divorce in Illinois, one of the first questions you may ask is: “Is divorce mediation required in Illinois?” This is one of the most common concerns for couples—especially when children are involved. The answer depends on your situation and what issues you and your spouse are trying to resolve. In this blog, we’ll break down …

Ask Sam: What is the Difference Between a Trademark and a Service Mark?

When building a business, protecting your brand identity is essential. Two key legal tools for this protection are trademarks and service marks. While both serve to protect the uniqueness of your brand, they apply to different aspects of commerce. Understanding the distinction between the two can help you properly protect your intellectual property and avoid potential legal issues. Trademarks (TM) …