Trusts and limited liability companies (LLCs) are both legal vehicles that can be used to manage and protect assets, minimize taxation, and avoid probate. Whether a trust or an LLC is a better choice may depend on the type of asset, but you do not necessarily have to choose between the two. In fact, an LLC can be placed in …

Do It Now: Name a Guardian for Your Minor Child(ren)

We know it’s hard. Thinking about someone else raising your children can stop you in your tracks. It feels crushing and too horrific to consider. But you must. If you don’t, a stranger will determine who raises your children if something happens to you – your children’s guardian could be a relative you despise or even a stranger you’ve never …

Not Just Death and Taxes: 5 Essential Legal Documents You Need for Incapacity Planning

Comprehensive estate planning is more than your legacy after death, avoiding probate, and saving on taxes. Good estate planning includes a plan in place to manage your affairs if you become incapacitated during your life and can no longer make decisions for yourself. What happens without an incapacity plan? Without a comprehensive incapacity plan in place, your family will have …

Important Questions to Ask When Investing in a Vacation Property

According to the National Association of Home Builders, in 2018 there were approximately 7.5 million second homes, making up 5.5 percent of the total number of homes.[1] These homes are not only real estate that must be planned for, managed, and maintained, they are also the birthplace of happy memories for you and your loved ones. Following are some important …

How to Choose a Trustee

When you establish a trust, you name someone to be the trustee. A trustee does what you do right now with your financial affairs—collect income, pay bills and taxes, save and invest for the future, buy and sell property, provide for your loved ones, keep accurate records, and generally keep things organized and in good order. Key Takeaways You can …

Integrating Community Property Trust Into Your Estate Planning

A well-crafted estate plan is comprised of many individual parts, and careful, trust-based estate planning is the best way to ensure the highest possible quality of life for you and your loved ones. One way couples can make get the most mileage out of their estate plans is through community property trusts. This is a special type of trust that …

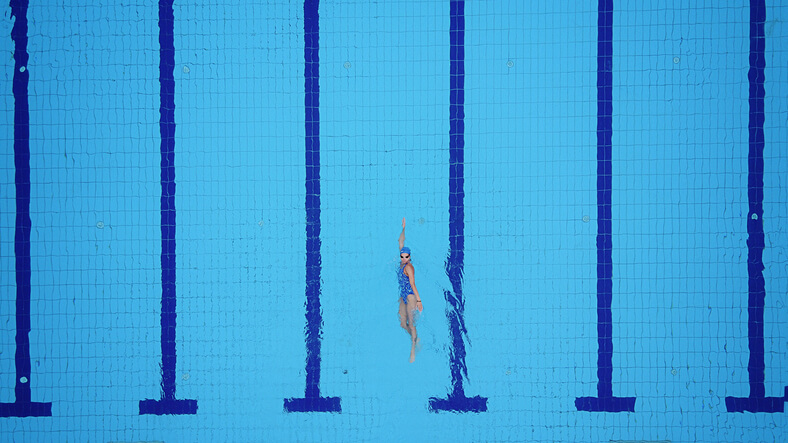

How Trusts Have Helped Athletes

Estate planning is not just about what happens when you die. Proper estate planning takes into consideration all aspects of your life and how to protect your accounts and property so that you can receive the maximum use and enjoyment during your life as well as protect whatever you choose to leave to your loved ones upon your death. A …

3 Reasons You Want to Avoid Probate

When you pass away, your family may need to visit a probate court in order to claim their inheritance. This can happen if you own property (like a house, car, bank account, investment account, or other asset) in only your name. Although having a will is a good basic form of planning, a will does not avoid probate. Instead, a …

Who Should I Choose to Be Successor Trustee

When you create a living trust, you must name a successor trustee to take over for you if you are unable to act due to incapacity or death. It is crucial that this decision be given careful consideration and that the right person be selected for the job. Role of Successor Trustee If you become unable to manage your financial …

Wondering Whether You Need to Update Your Estate Plan? Yes, You Do, and Here’s Why

Please allow us to be frank. It’s unrealistic to think that a piece of paper you draft, reflecting your life at a certain time, will work when your life has completely changed some years later. We’ll use the Kendrick family as an example. Meet the Kendricks Meet Bill and Karen Kendrick. They got their first estate plan in place when …

Why a Trust Is the Best Option for Avoiding Probate

As Ambrose Bierce once darkly observed, “Death is not the end. There remains the litigation over the estate.” Obviously, ideally, when someone passes away, the paperwork and material concerns associated with the estate are so flawlessly handled (thanks to excellent preparation) that they fade into the background, allowing the family to grieve and remember in peace. In fact, the whole …

Estate Planning Considerations for Couples with Age Gap

With couples of similar ages, planning for the future is naturally a joint effort. However, if you are married to someone who is significantly older or younger than you, the future can look different and mean different things to each of you. To protect yourself, your spouse, and other loved ones, you need to have comprehensive financial and estate plans. …