A well-crafted estate plan is comprised of many individual parts, and careful, trust-based estate planning is the best way to ensure the highest possible quality of life for you and your loved ones. One way couples can make get the most mileage out of their estate plans is through community property trusts. This is a special type of trust that …

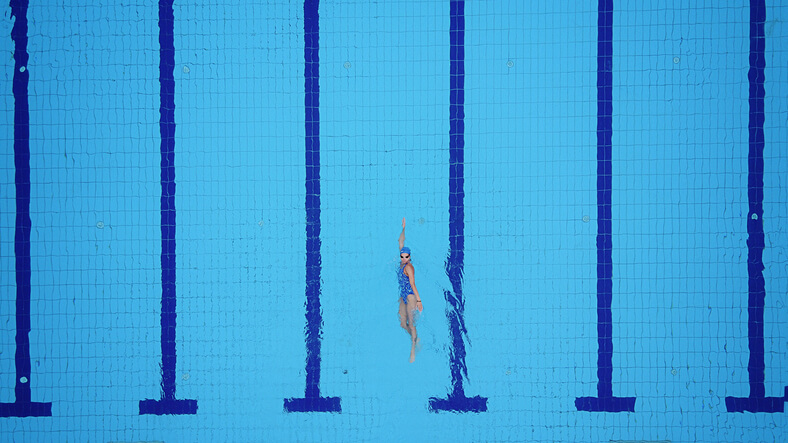

How Trusts Have Helped Athletes

Estate planning is not just about what happens when you die. Proper estate planning takes into consideration all aspects of your life and how to protect your accounts and property so that you can receive the maximum use and enjoyment during your life as well as protect whatever you choose to leave to your loved ones upon your death. A …

3 Reasons You Want to Avoid Probate

When you pass away, your family may need to visit a probate court in order to claim their inheritance. This can happen if you own property (like a house, car, bank account, investment account, or other asset) in only your name. Although having a will is a good basic form of planning, a will does not avoid probate. Instead, a …

Wondering Whether You Need to Update Your Estate Plan? Yes, You Do, and Here’s Why

Please allow us to be frank. It’s unrealistic to think that a piece of paper you draft, reflecting your life at a certain time, will work when your life has completely changed some years later. We’ll use the Kendrick family as an example. Meet the Kendricks Meet Bill and Karen Kendrick. They got their first estate plan in place when …

Why a Trust Is the Best Option for Avoiding Probate

As Ambrose Bierce once darkly observed, “Death is not the end. There remains the litigation over the estate.” Obviously, ideally, when someone passes away, the paperwork and material concerns associated with the estate are so flawlessly handled (thanks to excellent preparation) that they fade into the background, allowing the family to grieve and remember in peace. In fact, the whole …

Estate Planning Considerations for Couples with Age Gap

With couples of similar ages, planning for the future is naturally a joint effort. However, if you are married to someone who is significantly older or younger than you, the future can look different and mean different things to each of you. To protect yourself, your spouse, and other loved ones, you need to have comprehensive financial and estate plans. …

Choosing the Right Beneficiary

While estate planning allows you the freedom to choose who will receive your money and property upon your passing, struggling to determine who should receive your accounts and property at your death may prevent you from starting the process. You should not let this stop you from creating an estate plan, however. Whether it is naming a person or organization …

Estate Planning Strategies to Protect Your Spouse

You have searched for and found the love of your life, maybe your first love, or maybe after a previous marriage. As you have built your life together, you have probably weathered your fair share of storms and grown stronger because of them. To prepare for the future and the possibility of no longer being around for your spouse, it …

How Often Do You Update Your Estate Plan? More Often Than Your Resume?

A resume is a “snapshot” of your experience, skill set, and education which provides prospective employers insight into who you are and how you will perform. Imagine not updating that resume for 5, 10, or even 15 years. Would it accurately reflect your professional abilities? Would it do what you want it to do? Likely not. Estate plans are similar …

5 Tragic Mistakes People Make When Leaving Assets to Their Pets

A pet trust is an excellent way to make sure your beloved pet will receive proper care after you pass on. The problem, of course, is that you won’t actually be there to see that your wishes are carried out. It’s critical to set up a pet trust correctly to ensure there are no loopholes or unforeseen situations that could …

Passing Along a Benefit, Not a Burden

Most business owners have their estate planning prepared because they are worried about what will happen to their business after they are dead. However, proper estate planning has the added benefit of allowing you to make plans for what will happen if you are incapacitated or needing to be away from your business for an extended period of time. As …

What is an Inheritor’s Trust?

When it comes to estate planning there are several types of tools you can use, depending on your circumstances. One such estate planning tool is the trust. There are numerous types of trusts aimed at fulfilling different estate planning purposes. If you are anticipating an inheritance, there is a special type of trust designed to help protect it: an inheritor’s …