All children are a blessing. From the day they are born, you begin making plans to ensure that your child or grandchild has a bright future. What will their interests be? What job will they have? Who will they marry? While these are common concerns for most families, for those with a special needs child or grandchild, taking steps to …

Retirement Planning for Business Owners

For many employees, saving for retirement is usually a matter of simply participating in their employer’s 401(k) plan and perhaps opening an IRA for some extra savings. But, when you’re the owner of a business, planning for retirement requires proactivity and strategy. It’s not just the dizzying array of choices for retirement accounts, there’s also planning for the business itself. …

Do you really need a will?

Most Americans do not have a simple will as part of their estate plan. You might believe that a will is only for the rich and famous, and not the average person who has a far smaller net worth. On the other hand, you may think that a will is entirely unnecessary since you have a trust, jointly owned property, …

A Trust for Fluffy or Fido?

Estate planning is about protecting what’s important to you. Although much of the traditional estate planning conversation focus on surviving spouses, children, grandchildren, many pet parents wonder about what could happen to their “furry children” after their death or if they become incapacitated and unable to care for the pets. Read on if you’ve ever thought, “What will happen to …

Should your child’s guardian and trustee be the same person?

If you have overheard any discussion about estate planning, you have likely heard the words “guardian” or “trustee” tossed around in the conversation. When it comes to estate planning, who will be ultimately in charge of your minor child is an important decision that requires consideration of many factors. Although there is no substitute for you as a parent, a …

3 Famous Pet Trust Cases and the Lessons We Can Learn from Them

Not long ago, pet trusts were thought of as little more than eccentric things that famous people did for their pets when they had too much money. These days, pet trusts are considered mainstream. For example: in May 2016, Minnesota became the 50th (and final) state to recognize pet trusts. But not every pet trust is enacted exactly according to …

Protecting Your Children’s Inheritance When You are Divorced

Consider this story. Beth’s divorce from her husband was recently finalized. Her most valuable assets are her retirement plan at work and her life insurance policy. She updated the beneficiary designations on both to be her two minor children. She did not want her ex-husband to receive the money. Beth passes away one year after her divorce. Her children are …

3 Tips for Overwhelmed Executors

While it is an honor to be named as an executor of a will or estate, it can also be a sobering and daunting responsibility. Being an executor (sometimes called a personal representative) requires a high level of organization, foresight, and attention to detail to meet responsibilities and ensure that all beneficiaries receive the assets to which they are entitled. …

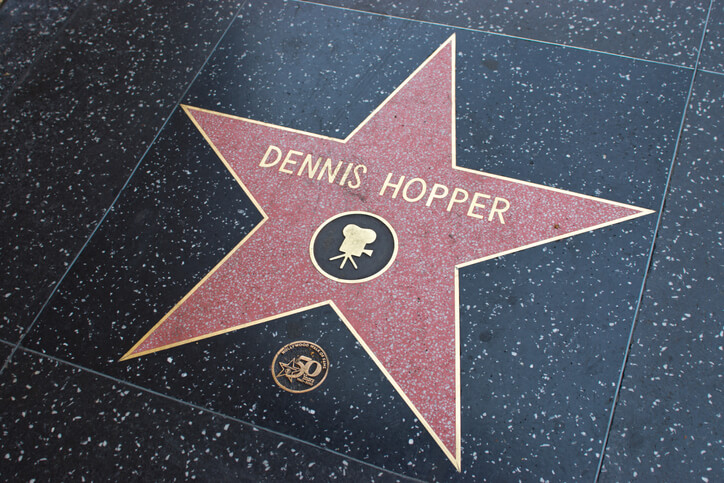

Dennis Hopper Saves Heirs with Last Minute Estate Plan Changes

Dennis Hopper, known for his role in Easy Rider, wanted to leave his fortune to his family. Well, not everyone in his family. Hopper made numerous estate planning changes in the last months of his life. His goal? To make sure his heirs shared his approximately $40 million in wealth and that his fifth, and current wife, Victoria, did not. …

How to Pick a Trustee, Executor, and Agent Under a Power of Attorney

While the term fiduciary is a legal term with a rich history, it very generally means someone who is legally obligated to act in another person’s best interests. Trustees, executors, and agents are all examples of fiduciaries. When you pick trustees, executors, and agents in your estate plan, you’re picking one or more people to make decisions in your and …

Your Post-Honeymoon Legal Checklist

Your wedding is over, and the day was absolutely perfect. You went away on your honeymoon with your new spouse and had the time of your lives. Now you are back and can breathe a sigh of relief and watch the rest of the years ahead unfold before your eyes. Well, not so fast. Now that your honeymoon is over, …

Do you really need a trust?

Although many people equate “estate planning” with having a will, there are many advantages to having a trust rather than a will as the centerpiece of your estate plan. While there are other estate planning tools (such as joint tenancy, transfer on death, beneficiary designations, to name a few), only a trust provides comprehensive management of your property in the …