Although cryptocurrency may be one of the latest investment strategies with great potential, for some individuals and their loved ones, investing in cryptocurrency has not gone as planned. The following stories are each a little different, but they all underline one simple warning: if you own cryptocurrency, you need a plan. Impact of Volatility on Estate Administration Matthew Mellon, an …

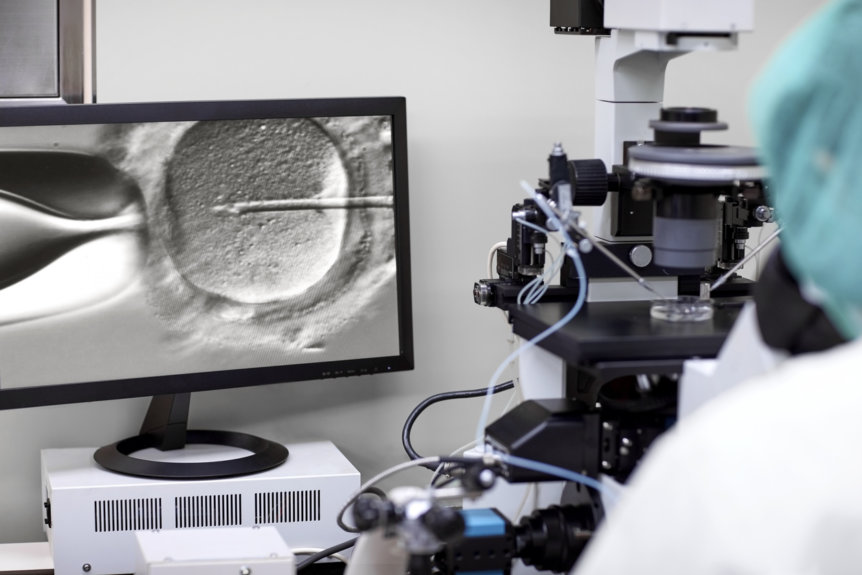

Top Four Estate Planning Questions to Answer When Using Assisted Reproductive Technology

Welcoming a child into the family is a major milestone in every parent’s life, especially if you have utilized assisted reproductive technology (ART). With this blessing comes the need for comprehensive financial and estate plans that are uniquely tailored to your family’s needs. As you continue your journey, we want to provide you with answers to some common questions you …

Pros and Cons of a Family Limited Partnership

Owning your own business or investment portfolio can be incredibly rewarding. However, to preserve the fruits of your labor and dedication, you must do everything you can to protect it. Whether you seek to protect yourself, your investments, and your family from taxes, creditors, or probate, a family limited partnership (FLP) is a strategy worth considering. What is a family …

Updating Your Estate Plan: How Many Tweaks Are Too Many?

If your life or the law has changed since you signed your last will and testament (will) or trust agreement, you need to update your document. You can make updates to a revocable living trust by way of an amendment or a complete restatement of the trust agreement. An amendment updates a specific part of the trust whereas a restatement …

Your 5 Task Year-End Estate Planning To-Do List

As we all prepare for the holidays and a new year, it is important that we wrap up any loose strings. Before entering into the new year, here are some things that need to be on your end of year checklist: Make Sure Your Estate Planning is Up To Date Will or Trusts Now that the federal estate tax exemption …

Wills, Trusts & Dying Intestate: How They Differ

Most people understand that having some sort of an estate plan is a good thing. However, many of us don’t take the steps to have an estate plan prepared because we don’t understand the nuances between wills and trusts – and dying without either. Here’s what will generally happen if you die, intestate (without a will or trust), with a …

Estate Planning: Why Me, Why Now, and Is a Will Enough?

You have worked hard for years, have family members and friends you care about, and have approached a time in your life when “estate planning” sounds like something you should do, but you are not exactly sure why. You may feel that you are not wealthy enough or old enough to bother or care. Or you may already have a …

Kids Going Away To College?

You may have been running around for weeks, getting your new college student off to school. It’s exhilarating, and your heart likely is bursting at the seams. You’re probably prouder than words can express, but you’re also a little afraid, too. How can you make sure your kid is going to be safe at school, their new home away from …

Wills vs. Trusts: A Quick & Simple Reference Guide

Confused about the differences between wills and trusts? If so, you’re not alone. While it’s always wise to contact experts like us, it’s also important to understand the basics. Here’s a quick and simple reference guide: What Revocable Living Trusts Can Do – That Wills Can’t Avoid a conservatorship and guardianship. A revocable living trust allows you to authorize your …

Strategies for Reducing the Income Tax Squeeze on Irrevocable Trusts

Under federal income tax laws, irrevocable, non-grantor trusts (such as Bypass Trusts and Dynasty Trusts) are subject to highly compressed income tax brackets. In 2014, the top 39.6% tax rate kicks in at only $12,500 of trust income. In addition, trusts in the top tax bracket are subject to the 20% long-term capital gains rate and a 3.8% surtax on …

Don’t Leave Your Trust Unguarded: 6 Key Ways a Trust Protector Can Help You

Trust protectors are a fairly new and commonly used protection in the United States. In short, a trust protector is someone who serves as an appointed authority over a trust that will be in effect for a long period of time. Trust protectors ensure that trustees: maintain the integrity of the trust, make solid distribution and investment decisions, and adapt …

Decanting: How to Fix a Trust That Isn’t Getting Better With Age

While many wines get better with age, the same cannot be said for some irrevocable trusts. Maybe you’re the beneficiary of trust created by your great grandfather over seventy years ago and that trust no longer makes sense. Or, maybe you created an irrevocable trust over twenty years ago and it no longer makes sense. Wine connoisseurs may ask: Is …