Although cryptocurrency may be one of the latest investment strategies with great potential, for some individuals and their loved ones, investing in cryptocurrency has not gone as planned. The following stories are each a little different, but they all underline one simple warning: if you own cryptocurrency, you need a plan. Impact of Volatility on Estate Administration Matthew Mellon, an …

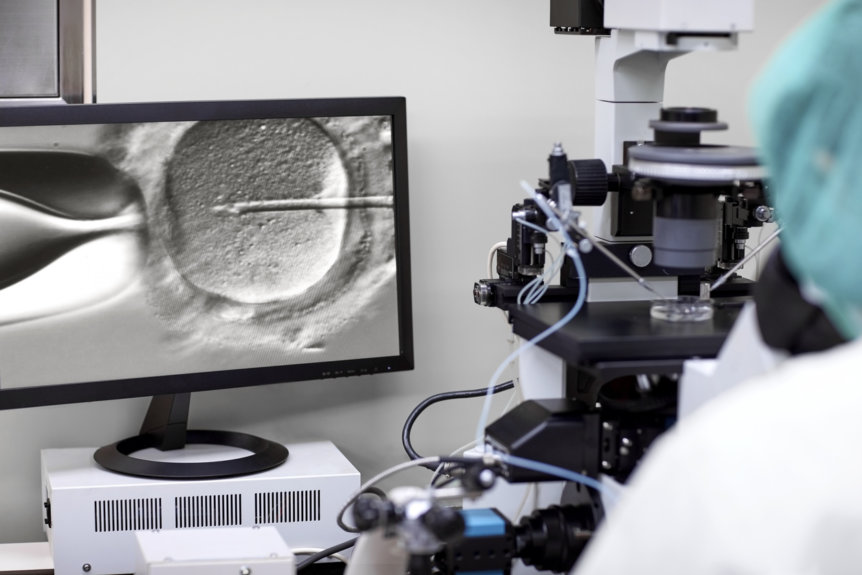

Top Four Estate Planning Questions to Answer When Using Assisted Reproductive Technology

Welcoming a child into the family is a major milestone in every parent’s life, especially if you have utilized assisted reproductive technology (ART). With this blessing comes the need for comprehensive financial and estate plans that are uniquely tailored to your family’s needs. As you continue your journey, we want to provide you with answers to some common questions you …

Pros and Cons of a Family Limited Partnership

Owning your own business or investment portfolio can be incredibly rewarding. However, to preserve the fruits of your labor and dedication, you must do everything you can to protect it. Whether you seek to protect yourself, your investments, and your family from taxes, creditors, or probate, a family limited partnership (FLP) is a strategy worth considering. What is a family …

Conservatorship: Understanding Child Custody Laws in Texas

How does child custody work in Texas? In Texas, the concept of child custody is discussed in terms of both conservatorship and possession. In general, conservatorship has to do with a parent’s right to make decisions about the child, while possession has to do with a parent’s right to spend time with the child. Where parents of a child are …

Updating Your Estate Plan: How Many Tweaks Are Too Many?

If your life or the law has changed since you signed your last will and testament (will) or trust agreement, you need to update your document. You can make updates to a revocable living trust by way of an amendment or a complete restatement of the trust agreement. An amendment updates a specific part of the trust whereas a restatement …

Your 5 Task Year-End Estate Planning To-Do List

As we all prepare for the holidays and a new year, it is important that we wrap up any loose strings. Before entering into the new year, here are some things that need to be on your end of year checklist: Make Sure Your Estate Planning is Up To Date Will or Trusts Now that the federal estate tax exemption …

Illinois Family Law: Remedies for Abuse of Allocated Parenting Time

Going through a divorce is complicated, even more so when children are involved. Once you have finally arrived at a judicially-mandated order or approved agreement with respect to the custody and visitation rights of each parent, it can be devastating for your ex-spouse to repeatedly violate that order or agreement. In this blog, I discuss the relief available when your …

Balance Sheets: What Are They and Why Are They Important?

A balance sheet is a financial statement that provides a snapshot of a company’s financials at a specific time. Also known as a statement of financial position, a balance sheet shows what the company owns that can be converted to cash (assets), its debts and financial obligations (liabilities), and its net worth (owner’s equity or shareholder’s equity). By knowing the …

Is My Electronic Signature Valid?

Some of us remember when, to sign a document, it was necessary to print out the form, physically sign it, scan the signed document, and then send it as an email attachment. Electronic signatures have made this process all but obsolete. Nowadays, for most transactions that require us to sign our name, we can apply a digital signature that satisfies …

Legal Considerations for Buying an Existing Business

Some entrepreneurs love the challenge of starting a new business and creating everything from scratch. However, that may not be the best approach for everyone. Buying an existing business can eliminate the initial legwork of establishing a customer base, training employees, and securing start-up funding, but it is not without its own challenges. As a prospective business buyer, part of …