Being someone’s guardian can be an overwhelming new journey. Understanding what is expected of you in this new role is the best way to reduce any apprehensions so that you can care for your loved one in need. In the State of Illinois, guardianship is split into two separate types. Just like you need a Power of Attorney to appoint …

How Your Lawyer Can Support Business Wellness in 2023

January is when we turn the calendar ahead to a new year that is full of hope and fresh opportunities. Recognized as Financial Wellness Month, January is an ideal time to set business goals for the upcoming calendar year. Achieving business wellness in 2023 can go a long way toward improving your overall physical health. Financial health and personal health …

Why a Trust Is the Best Option to Avoid Probate

Ideally, when someone passes away, the paperwork and material concerns associated with the deceased’s passing are so seamlessly handled (thanks to excellent preparation) that they fade into the background, allowing the family and other loved ones to grieve and remember the deceased in peace. In fact, the whole business of estate planning—or at least a significant piece of it—is concerned …

Understanding Land Trusts: Title-Holding Land Trusts

What is a land trust? The use of the phrase “land trust” can often lead to confusion, as it relates to a few completely distinct concepts. On the one hand, a land trust may refer to an estate planning tool wherein title to the land is held by a trustee at the owner’s request. On the other hand, a land …

Three Reasons to Avoid Probate

When you pass away, your family may need to sign certain documents as part of a probate process in order to claim their inheritance. This can happen if you own property (like a house, car, bank account, investment account, or other asset) in your name only and you have not completed a beneficiary, pay-on-death, or transfer-on-death designation. Although having a …

Three Tips for Overwhelmed Executors

While it is an honor to be named as a trusted decision maker, also known as an executor or personal representative, in a person’s will, it can often be a sobering and daunting responsibility. Being an executor requires a high level of organization, foresight, and attention to detail to meet responsibilities and ensure that all beneficiaries receive the accounts and …

Your Planning Team for Your Next Adventure

When planning your next great travel adventure, you may decide that you can do it yourself. You know what you and your travel companions want to see and do, how much you are willing to pay, and the most convenient times to travel. While making travel arrangements may be okay to do yourself, you need to consider calling in a …

How to Prepare Your Business for the New Year

The beginning of the year is a time to reflect and refocus on what you want to achieve over the next twelve months. Optimally, entrepreneurs spent part of December on small business housekeeping tasks that helped them finish the year strong, and at the beginning of January, they prioritize setting themselves up to look ahead confidently. Reviewing key performance indicators …

Don’t Let Your Cryptocurrency Give You and Your Loved Ones Nightmares

Although cryptocurrency may be one of the latest investment strategies with great potential, for some individuals and their loved ones, investing in cryptocurrency has not gone as planned. The following stories are each a little different, but they all underline one simple warning: if you own cryptocurrency, you need a plan. Impact of Volatility on Estate Administration Matthew Mellon, an …

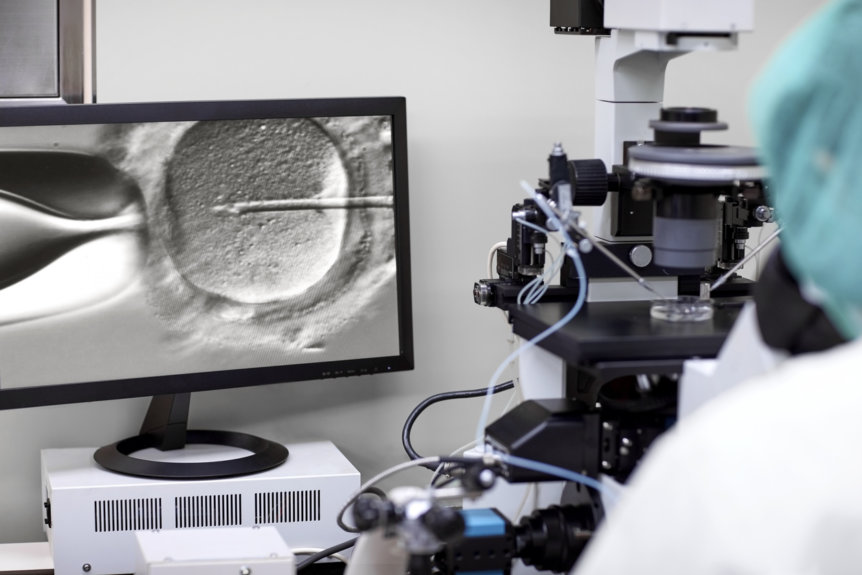

Top Four Estate Planning Questions to Answer When Using Assisted Reproductive Technology

Welcoming a child into the family is a major milestone in every parent’s life, especially if you have utilized assisted reproductive technology (ART). With this blessing comes the need for comprehensive financial and estate plans that are uniquely tailored to your family’s needs. As you continue your journey, we want to provide you with answers to some common questions you …

Pros and Cons of a Family Limited Partnership

Owning your own business or investment portfolio can be incredibly rewarding. However, to preserve the fruits of your labor and dedication, you must do everything you can to protect it. Whether you seek to protect yourself, your investments, and your family from taxes, creditors, or probate, a family limited partnership (FLP) is a strategy worth considering. What is a family …