As a family law attorney practicing in Illinois, Greater New York City and Texas, I work with individuals and families navigating some of life’s most emotionally and logistically challenging transitions. Whether you’re going through an uncontested divorce, pursuing mediation or collaborative divorce, or separating as a farming couple with complex property needs, the road ahead can feel uncertain. Books can …

Celebrating 15 Years of Rincker Law PLLC: A Journey of Growth, Success, and Service

Wow—15 years! It’s hard to believe that Rincker Law has been serving clients for a decade and a half. And in true fashion, I realized that I never even did a 10-year anniversary blog! But life moves fast when you’re dedicated to building a business, serving clients, writing books, launching podcasts, and, of course, becoming a mother. To mark this …

Rincker Law is Hiring an Agriculture and Business Law Associate Attorney!

Rincker Law, PLLC is a nationally recognized law firm with offices in Illinois, Connecticut, Kentucky, New Jersey, New York, and Texas. Our firm is dedicated to providing exceptional legal services to help individuals, who are part of families, to strengthen our communities. We believe strong families, especially agriculture families, strengthen our communities. And we love our communities. That is what …

Meet Chelsea Jannereth: Rincker Law’s Newest Associate Attorney in Champaign

We are thrilled to introduce Chelsea Jannereth as the newest Associate Attorney at Rincker Law, PLLC in our Champaign office! Chelsea joins us with a wealth of experience in family law and civil litigation, and we couldn’t be more excited to have her as part of our team. Chelsea has a passion for collaborative law and mediation, which perfectly aligns …

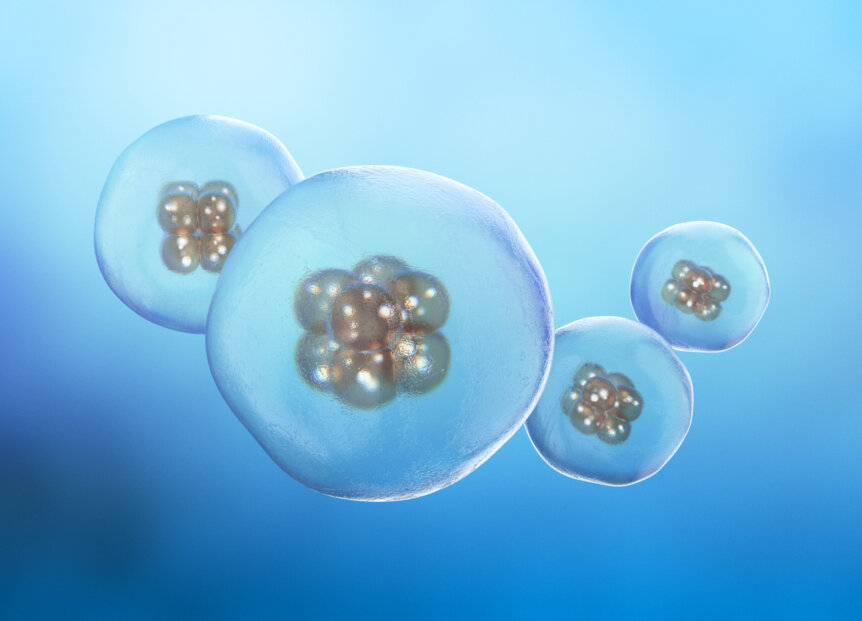

Fertility Law Case Summary: LePage (SC-2022-0579)

On February 16, 2024 the Supreme Court of Alabama decided in LePage v. The Center for Reproductive Medicine, P.C. that fertilized eggs are children for the purpose of Alabama’s wrongful death of a minor statute. The court held that all ‘unborn children’ whether inside or outside the womb are protected within the plain language of the statute. Alabama’s Wrongful Death …

Using Assisted Reproductive Technology: What Happens to Unused Genetic Material at Your Death?

When you think about how you want your property to be distributed after your death, most of the time it is easy to identify that property—your home, your cars, your jewelry, etc. But what about the genetic material used in assisted reproductive technology, such as frozen sperm, eggs, and embryos? Is genetic material stored with your doctor or a fertility …

Process for Obtaining a Guardianship in Illinois Over a Minor

In the State of Illinois, there are three types of guardianships of a minor. You can be the guardian of a minor’s person, a minor’s estate, or a minor’s person and estate. Regardless of which type of Guardianship of a Minor is needed, the process is typically the same. A Guardianship of a Minor’s Person is needed when a minor’s …

Resolving Jurisdictional Disputes in Adult Guardianship Proceedings: The UAGPPJA

Adult guardianship proceedings are complicated in their own right, but sometimes jurisdictional confusion adds an extra layer of difficulty. There may be no question about the appropriate jurisdiction for an adult guardianship proceeding where all relevant parties have lived, and continue to live, in the same jurisdiction; however, such is not always the case given the increasing mobility of the …

Illinois Guardianship Law: Differences in Guardianship over the Estate vs. Guardianship over the Person in Illinois

Being someone’s guardian can be an overwhelming new journey. Understanding what is expected of you in this new role is the best way to reduce any apprehensions so that you can care for your loved one in need. In the State of Illinois, guardianship is split into two separate types. Just like you need a Power of Attorney to appoint …

Illinois Family Law: Remedies for Abuse of Allocated Parenting Time

Going through a divorce is complicated, even more so when children are involved. Once you have finally arrived at a judicially-mandated order or approved agreement with respect to the custody and visitation rights of each parent, it can be devastating for your ex-spouse to repeatedly violate that order or agreement. In this blog, I discuss the relief available when your …

Prenups are for Young Couples, Too

Historically, prenuptial agreements (“prenups”) were regarded as instruments for those more mature couples who already have significant assets to their name. These days, the appetite for prenups is also gaining momentum among younger couples on the path to marriage, regardless of their wealth (or lack thereof). A prenuptial agreement between two younger individuals presents its own unique challenges, because often …

Illinois Matrimonial and Family Law: Post-Secondary Educational Expenses

Did you know that students with divorced parents in Illinois may be entitled to court ordered assistance with educational expenses by both parents? If you’re former spouse isn’t paying their fair share, read on to learn more about getting your child the help they need. How much support will a court order? Illinois courts have significant discretion to set the …