If you are in the process of starting a corporation, there are many important legal documents you must create and abide by to comply with your state’s laws and ensure that the corporation will operate efficiently. Corporate bylaws are one of the most critical documents to have in place. Bylaws lay the corporation’s foundations and include important information that your …

Stay Bonus Agreements: What They Are and How to Use Them

A stay bonus agreement, also referred to as a retention bonus agreement, is a written agreement between a company and a key employee to induce the employee to stay with the company. Understanding the definition and purpose of this type of bonus agreement is critical for both business owners and employees. A stay bonus agreement is a contract between a …

Can (and Should) My Business Mandate the COVID-19 Vaccine for Employees?

Just a year ago, businesses across the United States shuttered temporarily in response to the novel coronavirus. Some of these businesses could not weather the virus storm and closed for good. Now that COVID-19 vaccines are available, many businesses are wrestling with deciding when to resume in-person operations and bring their staff back full-time. At the time of writing, 1.5 …

Selling Your Small Business: What You Should Know

Determining whether to start a business is a major life decision. For small business owners, deciding when and how to sell the business is arguably even more consequential. Before selling a business, the owner is likely to spend many hours and even days worrying and considering the options: Is the market right? What price should I set for my business, …

How to Move a Business to Another State

A business owner may relocate a business to another state for a variety of reasons, including increased real estate costs, property taxes, business taxes, or business regulations in the old location; changes in the target market; or even personal or family reasons. Relocating your residence from one state to another requires that you complete several tasks, such as changing your …

Understanding Payroll as an Employer

Congratulations! Your business has grown and you are ready to hire your first employee. Where do you begin? What will the employee’s schedule be and how much will the employee get paid? Will your new hire be an employee or an independent contractor—and what is the difference? Did the employee sign an employment agreement? Before your new hire begins, there …

Ask Cari: Common Business Formation Mistakes

The key to a successful business is having the right people, financial knowledge, effective processes, and a well-researched business plan. According to the Bureau of Labor Statistics, approximately 20 percent of businesses fail in their first year, and 50 percent fail by their fifth year. Forming and running a business is hard regardless of whether the business provides products or …

Understanding Corporate Management: Who Is Really in Charge?

When you decide to form a business, one legal entity type you can choose is the corporation. The corporation is one of the more complex but also one of the most trusted legal business forms. A key consideration is the way a corporation is managed: it has an intricate structure, built-in oversight, and a somewhat flexible ownership scheme. Corporate structure …

Why Your LLC Needs an Operating Agreement

Congratulations! You have decided to form a limited liability company (LLC) to run your business. After completing your state formation process, your LLC needs to have the right documentation in place. An operating agreement, sometimes called a company agreement, is a legal document that describes and outlines how an LLC will run, and is an essential document for owning and …

Good News for PPP Recipients of $50,000 or Less: Simplified PPP Forgiveness Process

Following the first surge of COVID-19 cases in the United States, many businesses financially impacted by the pandemic have applied for federal funds through the federal government’s Paycheck Protection Program (PPP). One key element of the PPP is loan forgiveness, but business owners who received PPP funds must apply for loan forgiveness. If you received funds and are in the …

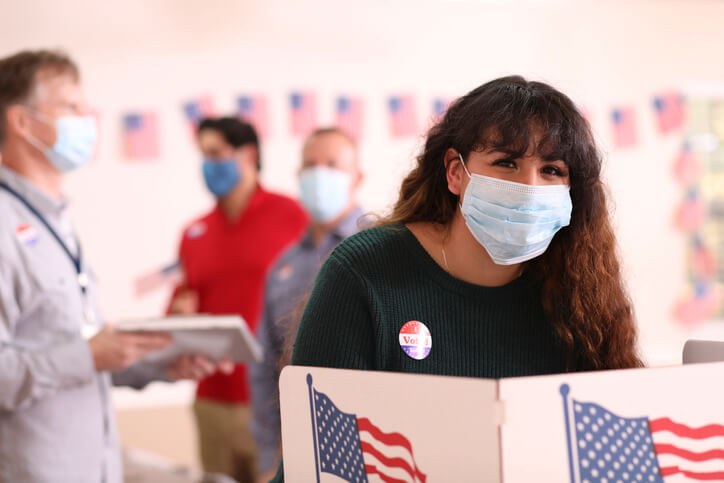

What You Need to Know about Elections and Your Business

With early voting already underway in some states and November 3 just around the corner, you may be wondering about your obligations as an employer to provide your employees the opportunity to vote. These questions are particularly important in light of the current pandemic and the high political tensions at play during this election. Here are three steps you can …

Ask Cari: What Is the Difference between a Limited Liability Company and a Corporation?

When starting a business, a business owner must first choose which type of entity to create. Two of the most popular entity types are the limited liability company (LLC) and the corporation. Choosing between these two types of entities can be difficult for business owners who are not familiar with the unique features of each type. To choose the right …